How to avoid the nine common tax filing mistakes

.ul_article li {list-style: disc;text-align: justify; } .ol_article li {list-style: decimal;text-align: justify; } The 9 most common tax filing mistakes and how to avoid them. With tax submissions and filing deadline dra...

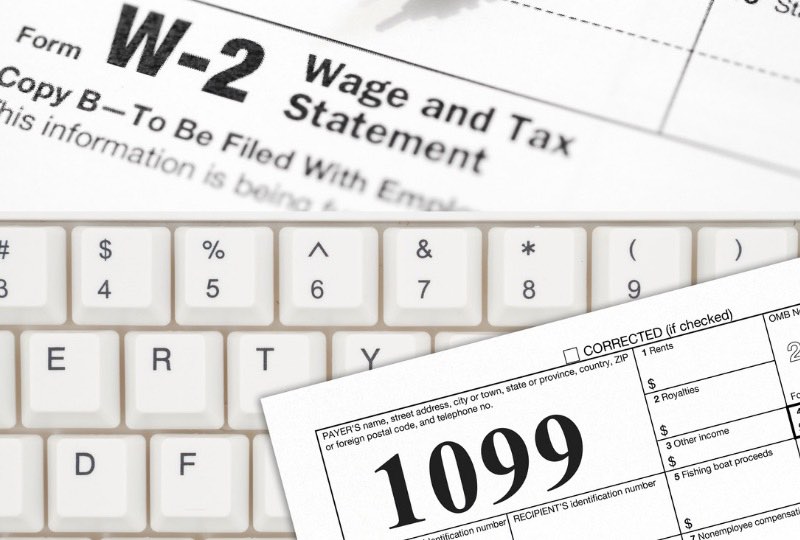

Difference Between W2 & 1099, And How To File For Both

It is very important that business owners know how to classify their workers, even if they have an accountant or payroll service to do the tedious work of calculating their compensation and making payments. Business owne...

4 Tips To Help Your Business Avoid Payroll Pitfalls

Whether you own a restaurant, an engineering firm, a tech startup or any other type of small business, there is one common element that can trip up any business: payroll. Payroll is a highly regulated area involving ev...

10 Payroll Tips You Should Know

Staying on top of payroll can be a time-consuming and stressful process. Especially if you take care of your payroll in-house, it can quickly become a nightmare for business owners. According to the National Business Ass...

12 Smart Things to Do With Your Tax Refund

1. Create an Emergency Fund Many Americans don’t have an adequate savings account accessible in case of a sudden financial need. A lack of savings leaves you vulnerable to a job loss, medical emergency or major repair ...

Top Reasons Your Tax Refund Could Be Delayed

When you're expecting a tax refund, the last thing you want to do is wait for it to show up. Fortunately, the turnaround time for tax return processing has sped up tremendously over the years, especially since the introd...

5 Hidden Ways to Boost Your Tax Refund

While Americans may disagree on how their taxes are spent, at tax time, most of us are looking for ways to pay no more than we owe, or even boost our tax refunds. These five strategies go beyond the obvious to give you t...